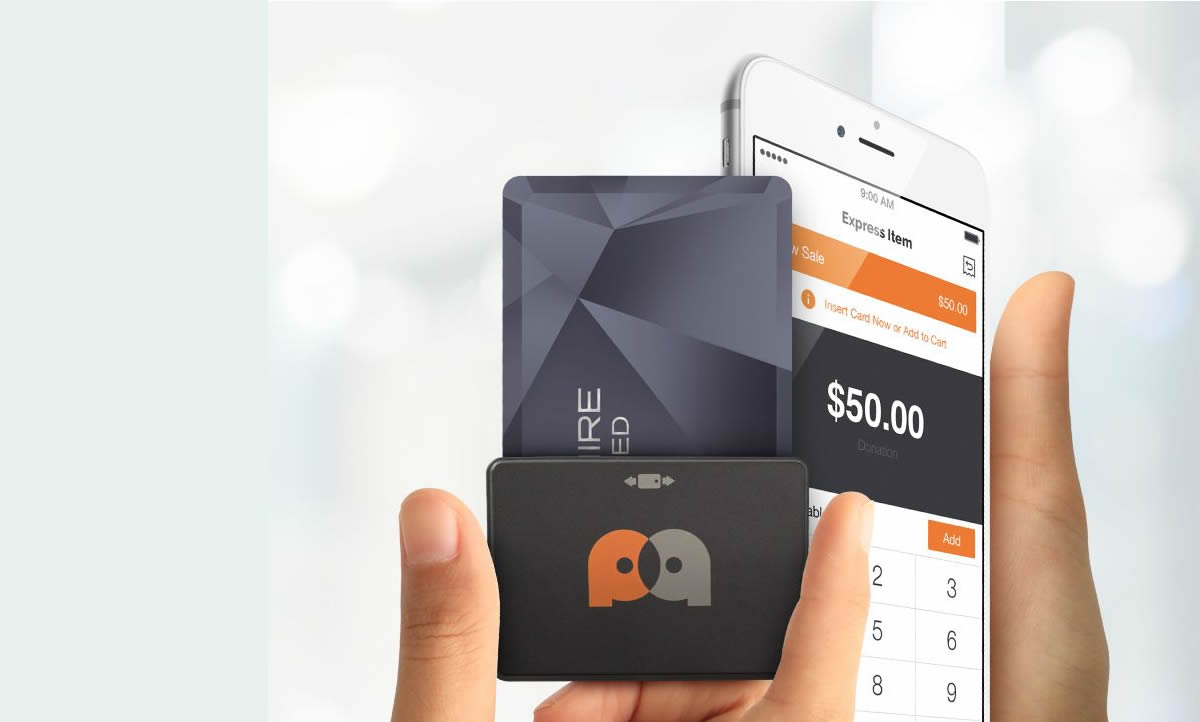

Mobile credit card processing

Now everything you need to process credit cards from your smartphone

When you sign up for a merchant account with Merchant Services Philadelphia, you get the benefit of a FREE mobile credit card processor. Our credit card swiper works with any smart phone and gives you the ability to accept credit cards in real time, in any environment. We offer one of the lowest swipe rates in the industry, and there are no monthly fees.

What is the best way to choose your credit card swiper?

There are so many mobile credit processing options out there, it can be overwhelming trying to choose the one that is best for you and your business. Start by focusing on the traits that will have the biggest impact on your business and lifestyle, including convenience and flexibility. There should be no (or minimal) upfront costs, and, most importantly, the processing rates should be competitive.

Since a mobile credit card processor has to be effective in many different locations, and under many different scenarios, you will want to make sure the swiper works even in areas with low internet signals or no Wifi. Make sure the cell phone swiper includes an “offline mode”. In offline mode, you can securely complete a credit card transaction and it will be automatically processed when your connectivity returns.

What are some of the downfalls of using Square?

If you run a very small business and need to get started quickly, there are some benefits to using a company such as Square. There are some downfalls as well. Consider:

- Only “eligible” businesses are qualified for a free magstripe reader. There are no guidelines to eligibility, you must sign up for an account and add the credit card reader to your shopping cart to find out if the discount applies to your business. If not, each magstripe reader will cost you $10. These credit card swipers are only good for magstripes. If you require a chip or contactless reader, they cost $49 per swiper. We offer our credit card swiper FREE of charge, including FREE shipping.

- The smart phone swiper does not include a receipt printer. The printer may be purchased for an additional $299. There are also extra charges for tablet stands and/or cash drawers. For instance, the full Square Register integrated POS system sells for $799, or you can get the Square Terminal for $299.

- While it is easy to open an account with Square – they only require basic information about your business and identity verification – that comes with one big trade-off. Square’s lack of vetting means that its underwriting department can quickly slap a hold on a large transaction until they determine your business’s level of risk. Or really, for any reason they deem appropriate. A quick look at the Consumer Affairs website shows a 2 star rating and multiple one star reviews for this reason alone.

“I was using these guys for online payment processing for over 1 year, then suddenly they close my account and freeze all of my funds owed to me with no explanation and nobody to talk to. Their customer support is always backed up and you cannot get through to a human. Their automated support and user forums are of no help. I have lost money and my business is down until I get a new payment processor. I though they were great until this happened. I will never use them again. I am switching to another payment processor. It is not worth the lost time and money to try to resolve issues with Square.”

The benefit of a merchant account over Square

One of the benefits of a merchant account is that even though the process is more involved and takes a little longer to finalize, you can be sure the underwriting department will thoroughly investigate every aspect of your business in an attempt to determine how likely it is your business will generate complaints that lead to chargebacks, claims of fraud, or anything else that processors are determined to avoid. This more intensive vetting leads to a level of trust between you and your processor, which means they are much less likely to hold or freeze your funds. At Merchant Services Philadelphia, our goal is to minimize any inconvenience to you and your business by problem-solving BEFORE a problem exists.

The customer support difference

Square’s customer service cannot come close to the assistance and care you will receive from Merchant Services Philadelphia. For instance, you will need to get a customer code to call in for support. This is difficult since live support is not available 24/7. To make matters worse, if your account is terminated (even if the decision is unfair or incorrect), you will find yourself locked out of support. This make it extremely hard to correct any issues or receive your funds. If you refer back to The Consumer Affairs website, you will find hundreds of complaints regarding this process.

“Has anyone dealt with this?? This is so insane and YOU CAN NOT REACH A SINGLE LIVING PERSON AT SQUARE which is insane insane insane! How can someone just hold a business’s money with no human follow up this insane, again I say. I have been a cash app customer for 5+ years. ave moved THOUSANDS of dollars through my personal cash app with no problem ever, not one time. My company’s first week week out and we are sandbagged with absolutely no one at square that cares. Any advice or response is appreciated, Thanks.”

Merchant Services Philadelphia has a dedicated account manager who can address any problems you’re having and provide support 24/7. We are just an email or phone call away!

Our Smart Phone Swiper

- Rate 2.69%

- No Transaction Fee

- No Monthly Fees

- Keyed Rate 3.49% + 19¢ per transaction

- No Contract

- No Application Fee

- No Cancellation Fee

- No PCI Security Fee

- FREE Smart Phone Swiper with FREE Shipping

Frequently Asked Questions

Why use our swiper?

With a few simple modifications, you can turn your cell phone into a mobile credit card processing terminal. Simply attach the credit card swiper to your cell phone and you are ready to accept credit card payments. Download the mobile app and you can keep track of your sales… cash, credit and debit. Consequently, your customers can split their payment method, paying part of their bill in cash and the rest on their credit or debit card. Transactions take seconds and you can email a receipt to your clients.

Mobile credit card processing works the same as a wired terminal.

Processing transactions using a cell phone is similar to processing transactions using a POS system or a wired terminal. Once you swipe the card, or manually enter in the card data, the payment type and the amount, the transaction is sent through the processing network. You will receive either a payment authorization or a declined payment. When a payment is declined, it can also include other messages which should be followed. For your authorized payments, you may want to write down the authorization number on your receipts for easier record keeping.

Mobile credit card processing without any equipment.

Another option for using your cell phone for mobile credit card processing is the “touch tone” method. This method does not require a swiper or any other equipment. Using the “touch tone” method, you place a call to a toll-free number to approve each transaction. After dialing the toll-free number, you follow the voice prompts to obtain an authorization code. You may have to dial different numbers depending on the type of payment. Your merchant account number is required when using this method. Since this is a paperless system, it is a good idea to write out a paper receipt for your customers, including the authorization code.